Generally, your business cash flows from your customers. Though there are times when you will have to pay out the money upfront and then get reimbursed when your customer pays for the product/service. For example, an employee takes the time to provide a service for your customers and your business pays that employee before you receive payment from your customer. Also, if you’re a sole proprietor with no payroll or reserves, you would have to wait to be paid for your work when the customer pays the bill.

In QuickBooks, this is called “billable expenses and billable time". In all the cases above QuickBooks can easily help you keep track of these transactions rather than just scribbling notes on a receipt.

To minimize their impact on your own cash flow you obviously want to be paid for these expenditures as soon as possible. So, when you create an invoice for a customer QuickBooks can remind you when your customer needs to be billed.

Tracking Your Billable Time

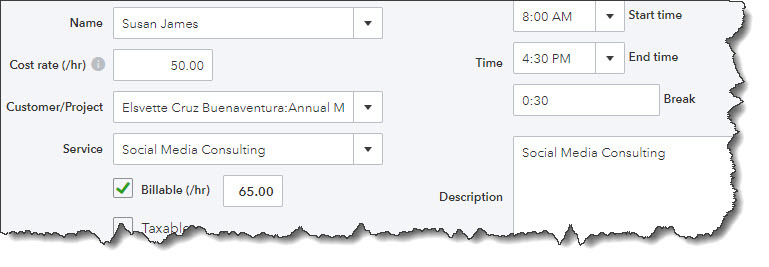

To create a billable time activity. Click +New, then Single time activity. Next, fill in the blanks and select items from drop-down lists until you’ve completed a form. The critical section of this screen is pictured below:

If you create a record of a billable single time activity, be sure you’ve marked it as such.

In the above example, an employee receives $50 per hour for work done which is the Cost rate. You need to click on the box in front of Billable to create a checkmark because the Service is provided will be billed back to the customer. You’re charging the customer $65/hour (a $15/hour markup), so you enter that number in the Billable field. You don’t have to worry about remembering that because as with all of your business information, QuickBooks retains the entry and makes it available to you.

Tracking Expenses

You likely already know how to record expenses in QuickBooks. You can either click the Expenses link in the toolbar and the New transaction | Expense or you can click the +New button and then Expense. You complete the fields and place a checkmark in the Billable column and select the Customer/Project from the drop-down list just like you did in recording time activities.

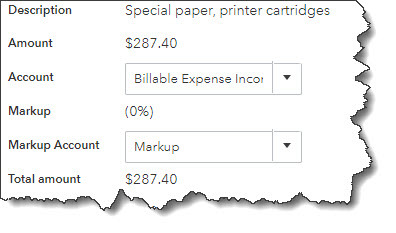

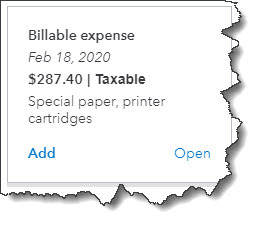

After you’ve saved a billable expense, it will appear in the table on the Expense Transactions page. To display it again, click View/Edit at the end of the corresponding row. The transaction will open, and you’ll notice that there’s a small View link in the Billable column. Click it, and you’ll see this:

This is a partial view of the Billable Expense screen

There has been no markup applied to the transaction in this example. If you want to add markup costs to all billable expenses, click the gear icon in the upper right and go to Account and settings | Expenses. Next, click the pencil icon to the far right of the Bills and expenses block of options. Then, click the box in front of Markup with a default rate of to create a checkmark and enter a percentage. All of your billable expenses will now include a markup of that percentage.

Time and Expenses Invoicing

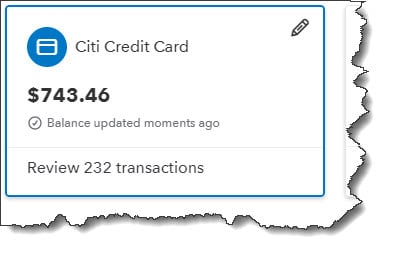

When you invoice a customer who has outstanding time and expenses, QuickBooks will remind you that they’re pending. Open an invoice form and select a customer who you know has billables. The right vertical pane will contain a box with information like this:

When a customer you’re invoicing has outstanding billable time and/or expenses, QuickBooks will remind you.

If you want to see the original expense record click Open. Clicking Add will include that transaction on the invoice.

There is another way to see your pending billables. Just click the Reports link in the toolbar and scroll down to the Who owes you section. Here you will see two related reports: Unbilled charges and Unbilled time. This will ensure you’re getting reimbursed for all your expenses and time incurred on behalf of your customers.

At Summit CPA we offer multiple resources to assist and help your business grow. If you’re ready to get an edge on your competitors? Contact our office at (866) 497-9761 to schedule an appointment with our advisors.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)