Budget Tips

Since the COVID-19 pandemic hit it may have been difficult for your business to stick your budget for the past several months. Unless the services and products you provide are in great demand, it’s possible that you’ve had to significantly adjust your budget.

Now that more people are getting vaccinated, there are still likely to be uncertainties. But, things are starting to reopen so this is a good time to start making adjustments and planning ahead for your budget. Having a budget increases your awareness of all of your projected income and expenses, which will make it less likely to find yourself short of funds.

10 ways to make your budgeting process more effective and realistic.

- Utilize what you know. You already have the best resource possible, that is, unless you’re starting a brand-new business. You can use the record of your past income and expenses as a basis for your projections.

- Recognize your sales cycle. Like a seasonal business, you likely already know that some months or quarters are better than others. This allows you to budget for those slower months.

- Differentiate between essential and non-essential expenses. You should enter your budget items for your bills and other expenses that should be covered before you add any optional categories.

You have the ability to use data from a previous year to create a new budget in QuickBooks.

You have the ability to use data from a previous year to create a new budget in QuickBooks.

- Make it simple. You risk budget burnout if you budget down to your last paper clip and your reports will be unwieldy.

- Figure in backup funding. You should try to create an emergency fund for your business just like you should for your personal life.

- Include your employees in the budget process. Try not to be secretive about the expenses of your budget, instead, ask your employees for input in the areas they have knowledge.

- Overrate your expenses. By over estimating your expenses, it will help prevent you from borrowing from one budget category to make up for any shortfall in another category.

- Think about using any excess funds to pay down debt. The sooner you can pay off your debt, the sooner you can those funds for some non-essential items. Debts cost you money if interest is involved.

- Are there areas where you can change vendors? When you create your budget consider each of your products and service suppliers. Is there a sufficient, yet less costly alternative available?

- Frequently review your budget. Re-evaluate your budget progress at least once a month. You could even start out by budgeting for only a couple of months at a time. This will teach our a lot about your spending and sales practices that you can use in the future.

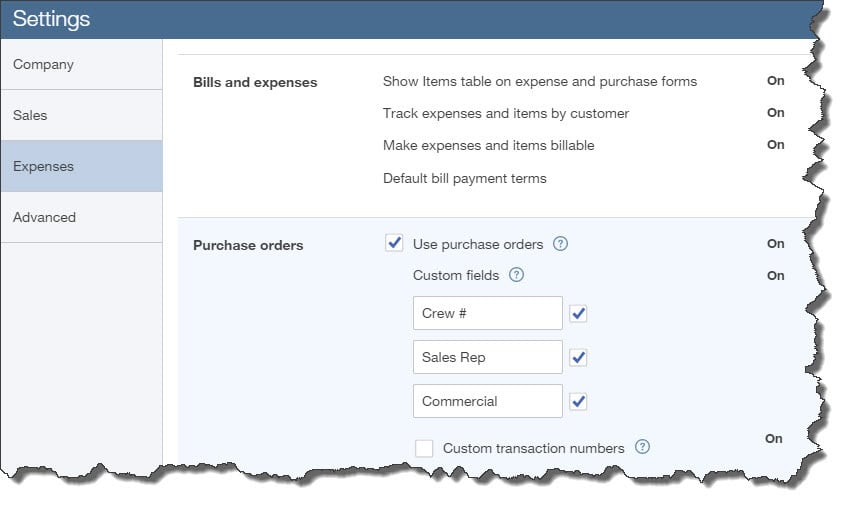

To help you create a budget QuickBooks offers built-in tools. First, click the gear icon in the upper right corner and select Budgeting under Tools. Next, Add budget. At the top of the screen, give your budget a Name and select the Fiscal Year it should cover from the drop-down list by that field. Choose an Interval (monthly, quarterly, or yearly) and indicate whether you want to Pre-fill data from an existing year.

QuickBooks supplies a budget template that already contains commonly used small business items.

The optional final field is labeled Subdivide by. Here you can set up budgets that only include selected Customers or Classes. Select the desired divider in that field, then choose who or what you want included in the next. Then click Next or Create Budget in the lower right corner (depending on whether you used pre-filled data) to open your budget template. If you subdivided the budget, you’ll see a field marked View budget. Click the down arrow and select from the options listed there.

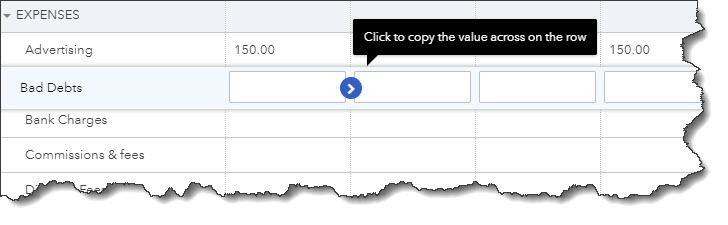

Just enter numbers in the small boxes supplied to create your budget. Depending on what you specified, the columns are divided by months or quarters, depending on what you specified, and rows are labeled with budget items (Advertising, Gross Receipts, Legal & Professional Fees, etc.). Just enter numbers in the boxes that apply. After you click in a box, a small arrow appears pointing right. Click here, and your number will automatically appear in the rest of that row’s boxes. When you’re done, click Save in the lower right. You can edit your budget at any time.

QuickBooks provides two related reports. Budget Overview displays all of the data in your budget(s). Budget vs. Actuals shows you how well you’re sticking to your budget.

Creating a budget can be challenging, but it’s very important, especially right now. QuickBooks’ budgeting tools and its other accounting features can help you get a better understanding of your finances.

At Summit CPA we offer QuickBooks consultation. If you would like further information on how we can assist you with your bookkeeping needs, contact our office at 866-497-9761 to schedule an appointment with our advisors.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)