The type of relationship you have with your clients can mean the difference between maintaining long-term, lucrative contracts or having a revolving door of one-time customers. At Summit CPA Group, A Division of Anders CPAs + Advisors, we serve as financial consultants, which means we are constantly engaging with our clients. Therefore, fostering long-lasting and positive working relationships is our goal, which has translated into significant financial success. Having a good working relationship with our clients means we have a much easier time providing services and ensuring they achieve their financial goals.

Like any other relationship, trust is the building block of a solid client-consultant relationship. Building a professional relationship on trust leads to transparency and better communication. These byproducts of building trust facilitate better working relationships. For example, the client is more likely to share information about themselves, which gives you better insight into what's happening with them and their business. Also, better communication between you and the client means you can mitigate potential issues and engage in difficult conversations that end in a resolution.

Once you establish trust with your clients, maintaining it is essential. By continuing to nurture the bond you've created, you're also working to retain your client base. The results of this effort mean you're more likely to have a steady stream of long-term work and a better chance at growing your client base. These results will have a positive impact on your bottom line.

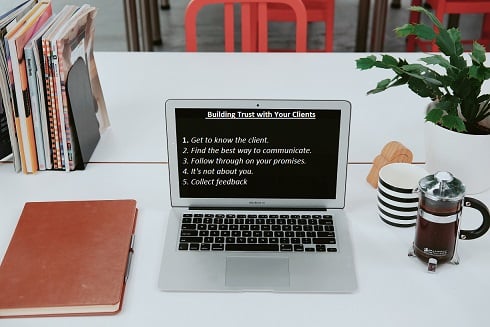

Detailed below are a few ways in which you can successfully establish and maintain trust with your clients.

- Get to know the client.

Learn more about your client beyond their financial statements and other facts and figures you can derive from their paperwork. The goal here is to recognize that they're much more than a name attached to a contract. You’re trying to bond and establish trust with a person, not a faceless company.

To get to know your client, start small. Try chatting about your weekend or after-work plans during meetings. If they're hesitant to share anything about themselves, try revealing some information about yourself to get them talking. While this may be awkward with clients who are reluctant to reveal anything about themselves, keep at it.

As the client begins to share more personal things about themselves, we recommend taking mental (or handwritten!) notes on what they say so that you can reference it later to foster conversation. Also, don't hesitate to vocalize the social milestones you hit with your clients. For example, if you make a particularly stoic client laugh during a meeting, note that out loud when it happens. Vocalizing these kinds of lighthearted observations is another way to establish a connection with your clients. - Determine the best way to communicate with your client.

While we recommend getting to know your client on a more personal level, it's imperative that you continuously read the room while trying to do so. Different clients will most likely require other communication methods. After all, there is no one-size-fits-all method for effectively communicating with different people.

Also, try to remain aware of how your client receives information and utilizes their time so that you can correctly adjust your approach to building trust with them as needed. For example, some people prefer to avoid small talk during business meetings. In those situations, keep discussions about your weekend plans to a minimum and figure out another way to break the ice. - Try to follow through on your promises.

Setting expectations on how you respond to and follow up with your clients can mitigate frustration and maintain trust as you continue to deliver on agreed-upon services. Following through in the way the client needs shows them that they can trust you to deliver on what you said you would do.

However, there will be times when things do not go as planned. For example, let’s say your system is down, and you cannot issue a report you told your client you would send by a specific time. In those instances, it's imperative that you communicate openly and honestly with the client so that they understand what's happening and the actions you're taking to try to keep your word. - Recognize that it's not about you.

Remember: you are the guide, and your client is the one on the journey. With that in mind, ask your clients questions with the intention of guiding them toward their goals. This intentional questioning and active listening shows the client that you have a genuine interest in ensuring they achieve their financial objectives and are trustworthy. - Collect feedback.

We suggest regularly checking in with your clients to see how they view your working relationship. At Summit, we send clients a short two-question survey that asks them to rate us and allows them to write in feedback. Consistently deploying this short survey to clients helps us identify areas where trust with the client has eroded.

After determining how you'd like to collect feedback from your clients, devise a plan so that if a client gives you negative feedback you can address the issue immediately and protect the trust you've worked to build.

Trust is the primary building block of a positive client-consultant relationship. It facilitates other qualities needed for healthy, functional relationships, like open communication and transparency. By following these recommendations, you will be much closer to building and maintaining trust with your clients, leading to a more expansive client base.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)