Know Your Numbers

One of the most important financial concepts that multiple financial institutions use (banks, mortgage, insurance companies and of course, yourself) is your net worth. This is a number that you not only need to know, but you need to understand how it can change over time.

Did you know that your net worth can affect your credit score, which can affect the interest rates you pay on a loan, and even your auto insurance?

What is net worth?

- Net worth is everything you own (assets) minus what you owe others (debts and liabilities).

- Assets include cash, bank account balances, investments, your home, vehicles or anything else that you could sell today

for cash. Your assets also include any businesses or business interests you own.

for cash. Your assets also include any businesses or business interests you own. - Liabilities are anything you owe others, such as a mortgage or car loan, as well as credit card or student loan debt.

How does net worth change?

Your net worth will change to reflect how you spend your money. For example, if someone were to spend more than they earn usually has a lot of bills and their bank account balance will likely be lower. It’s the same if you spend a lot on charge cards, your debt will increase and lower your net worth.

Who has a “net worth”?

Everyone. Even a 10-year-old that has money in their piggy bank has a net worth. If your child is saving up for something special, they will convert one asset (cash) into another asset (like new bike)!

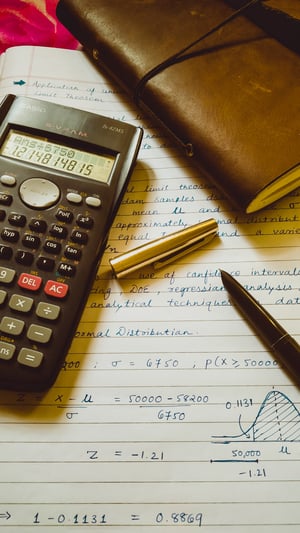

How to calculate net worth.

- Each month reconciling your bank accounts and loans will make it easier to calculate and track your net worth.

- Determine the value of all other assets. For example: Stocks, you will need to find the current value any stocks you own. You may have to estimate the value of any assets to find the amount you could sell them for today.

- When you add up the value of all your assets and subtract all your debts, you will see your net worth, good or bad.

Why it’s beneficial to know your net worth?

Your net worth is important so that you can see the bigger picture of your financial circumstances. It can benefit you in many different ways such as:

- Applying for student loans. When you submit your application for student loans and grants, you will need to include details of all your cash as well as any other assets. Your net worth will have an impact on the amount you may or may not have to pay towards your tuition bill.

- Applying for insurance. Certain insurance companies use your credit score to determine the amount of your premiums. The higher the net worth the more favorable the amount of your premium.

- Diversifying your investments. Some investments are only available to those who have a high net worth.

- Purchasing a home. Your bank will want to see sufficient amount of cash when compared to your debts. When you have too much debt, you will either need to increase your down payment and/or pay down your debts.

You have a better chance of achieving your financial goals when you know your net worth and how to calculate it.

At Summit CPA we offer multiple resources to assist you with all of your financial planning needs. Contact our office at 866-497-9761 to schedule an appointment with our advisors.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)