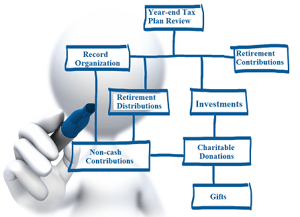

As we get closer to the years end it’s a good time to review your tax plan to make sure your plan is still on track. Here’s a check list to help you as you review your plan to ensure you receive all the deductions you are entitled too.

* Record organization. Be sure to update and organize your tax records and receipts so that you aren’t rushed at the end of the year. So that you’re not worrying about late fees and penalties, estimate your tax liability and make any required tax payments.

* Contributions and distributions. It’s time to make final contributions to your retirement plan. Are you eligible for catch up contributions? This is also the time to take any required minimum distributions from you retirement accounts. There is a costly penalty for not taking the required minimum distribution.

* Investments. Review your investments and any final investment gains and loses. If you have Capital losses, it can be used to net against any capital gains. Each year you may take up to $3,000 of capital losses in excess of capital gains, to lower your ordinary income.

* Non-cash contributions. You may donate non-cash items in good condition to charity. Be sure to take photos of the donated items and get a receipt from the charity receiving the donation.

* Charitable donations. Make a charitable donation. Think about making a donation with appreciated stock that you have owned for more than 1 year. Making a large donation usually gives you a larger deduction minus having to pay capital gains taxes.

* Gifts. You can give a tax-free gift up to $14,000 to an individual each year. This includes gifts given on birthdays, graduations, holidays, etc.

At Summit CPA we offer multiple resources to assist you with all of your tax and financial planning needs. Contact our office at 866-497-9761 to schedule an appointment with our tax advisors.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)