Our team discovers what your needs are and then uses specific criteria to itemize a set price. When you receive a quote from one of our authorized representatives, this price is all-encompassing, and unless circumstances change, there will be no hidden costs or miscellaneous fees. We price weekly because we are truly a member of your team, not simply another vendor you work with. Your employees won't increase their rates like a vendor might, and neither will we. We're not a traditional accountant that you see once per quarter or once per year. We're an extension of your team!

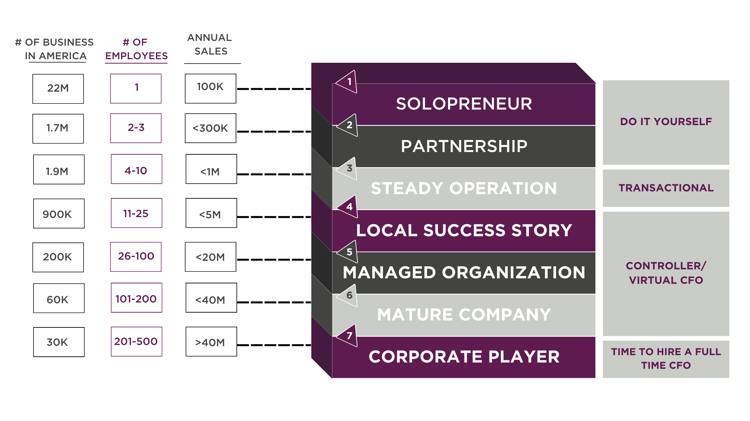

Take a look at the below infographic (data from Infusionsoft) to see what growth stage your company is:

For solopreneurs or partnerships, we can handle your basic business tax returns.

For steady operations, check out our Transactional value tier. At this point, we're not just assisting you with tax returns, but also with more strategic planning. We're not just a team of bookkeepers and accountants. We're experts in laying a solid financial foundation to help your business accelerate.

For steady operations, check out our Transactional value tier. At this point, we're not just assisting you with tax returns, but also with more strategic planning. We're not just a team of bookkeepers and accountants. We're experts in laying a solid financial foundation to help your business accelerate.

For local success stories, managed organizations and mature companies, check out our Controller or Virtual CFO value tiers. At this point, we're handling your accounts payable and receivable, and we're getting into much more strategic cash flow management and dynamic forecasting.

If you're ready to scale, this kind of dynamic forecasting is a critical component of your future growth.

When you get to the corporate player level, our processes and core business model are no longer a good fit. We typically recommend that you hire a full-time, staffed CFO to continue helping your business scale.

LEARN MORE ABOUT SUMMIT VIRTUAL CFO BY ANDERS AND THE SERVICES WE PROVIDE.

MANY BUSINESSES JUST LIKE YOURS GROW TO A POINT WHERE THEY NEED PROFESSIONAL FINANCIAL ADVICE BUT CAN’T AFFORD A FULL-TIME CFO OR CONTROLLER. OUR SERVICES AND EXPERIENCED TEAM CAN PROVIDE YOU WITH STRATEGIC SUPPORT FOR YOUR BUSINESS GOALS.